Garrett B. Gunderson (2018)

Visit book's Bookshop Page for details and support local, independent book stores.

A Critical Discovery

Page 3-4: Rockefeller’s objective was to deliver the best oil at the cheapest price. He once wrote to a partner “We must remember we are refining oil for the poor man and he must have it cheap and good”. And Rockefeller succeeded, pushing the price of oil down from 58 cents to 8 cents a gallon.

Page 4: Six generations later, the “Family Office” is still managing the Rockefeller fortune, which is estimated to be more than $10 billion. More than 150 Rockefellers currently receive interest income from the family trusts. And the family is said to donate as much as $50 million per year to charity, carrying on the senior Rockefeller’s tradition of philanthropy.

Page 10-11: Preserving and protecting financial wealth requires an understanding of, and a solid plan for, counteracting the three primary forces that erode wealth over multiple generations. Just as water, wind and gravity work to erode natural monuments, three forces work to erode financial wealth over multiple generations:

- The division of assets among the generations.

- Transfer taxes and capital gains taxes.

- Business risks and third-party attacks.

Studies have shown that as a result of these three forces, financial wealth doesn’t last pass the third generation in 90 percent of high-net-worth families. This truism has sometimes been expressed as “Shirt-sleeves to shirtsleeves in three generations,” an American translation of the Lancashire proverb, “There’s nobbut three generations between a clog and clog.”

Page 12-13: For example, if my descendants have a business idea, I want to empower them to start that business with the family trust rather than leaving them to try to make it happen while working a minimum wage job on the side. I want to help my kids pay for education without leaving them shackled in debt. And I want to to empower them to make a bigger impact in the lives of others by encouraging them to make good choices. I want my trust to be a magnifying glass for good and a deterrent for evil. If they’re not doing healthy, productive things, then they’re not going to get access to anything. But if they’re producing value, they will be empowered.

Can I Really Have My Own Family Bank?

Page 15: Cutting back can actually cost you. If you let yourself get into a scarcity mindset, you’ll miss out on opportunity. “Saving yourself rich” doesn’t actually work.

Page 16: Because the Rockefellers had a method to perpetuate and preserve wealth, rather than handing it down to each generation to start over again. The Rockefellers kept their wealth centralized, which allowed their family to become stronger.

Page 16: You can set up a trust that allows any descendent to use that money for an entrepreneurial program, a mastermind program, or a college education, for example. In order to access money they would write a plan to the board of the trust, saying, “I’d like to go to this college, and that it costs this much money, and I’d like to borrow that money from the trust.” It is, in essence, a family bank.

Page 17: When it comes to saving, protecting and growing your money, traditional banking is not your friend. First of all, banks pay atrociously low rates - 1% if you deposit at least $100,000. CDs are much the same. Government savings bonds pay less than 1%. Other investment vehicles like securities have eroding factors like management fees, which can be as high as 2%, plus there can be taxes that you have to pay on earnings. To get any kind of decent rate through traditional banking, you have to lock away your money for a long time, with no tax benefit.

Very simply put, Cash Flow Insurance is overfunding a permanent life insurance policy in order to use the cash value as a savings vehicle and personal bank.

Page 19-20: It’s easy to get a loan if you have good credit, good collateral and good cash flow. But if one of those things is disrupted, then when it’s time to get a loan, you are in trouble. When you utilize Cash Flow Insurance, you no longer have to apply for a loan. You no longer have to use your credit to take out a loan. You don’t have to fill out a whole bunch of paperwork. You don’t have to deal with a whole slew of obstacles - because you now have a system to access money inside your policy. It is your money that you can do with what you want. Moreover, you have flexible payback periods, amount and timelines. If the loan is utilized for business purposes, you may even be able to write off the interest. You can earn interest on your money while borrowing from the insurance company instead of paying interest to the bank, and you can build up your legacy plan and Rockefeller trust at the same time.

Page 21: When you put money in a bank, the bank puts a certain percentage of that money into life insurance as part of their reserve account. They do this because life insurance has tax favor and earns dividends that can lead to a higher interest rate than their other reserves. So why not just put your money into life insurance yourself, and take the bank out of it all together?

Page 22: Moreover if you want to borrow against or from the insurance company, all you have to do is make a phone call or send in a form. I have had my policies overnight me a check, or send a check by mail. Then I choose when I want to pay it back.

Page 22: If you utilize Cash Flow Insurance, and get everything properly set up, you’ll be able to pay for your kids’ college, pay off debt, finance your home or car, start a business, have an emergency fund - and earn interest the whole time. Cash Flow Insurance is instrumental to creating economic independence. It will increase your clarity and peace of mind by allowing you to know rather than hope.

But Dave Ramsey and Suze Orman Said No!

Page 27: Dave Ramsey claims that you can get ten to twelve per cent returns investing in a mutual fund. However, the vast majority of mutual funds don’t get anywhere close to that. Moreover, there isn’t any sense in comparing mutual funds or other savings vehicles to Whole Life insurance. Using Whole Life insurance as the foundation of your Cash Flow Insurance strategy isn’t necessarily considered an investment. It’s not one or the other. If you find an investment opportunity that will yield you twelve per cent, you can access money from your Whole Life Insurance policy to make the investment!

What Cash Flow Insurance Really Means

Page 33: Cash Flow Insurance has three key points:

- It safeguards your wealth.

- It helps you grow your money and increase your cash flow.

- It helps you enjoy your money today and tomorrow.

Page 34: Accumulation entails setting money aside in an investment vehicle and hoping that it grows; cash flow, on the other hand, means that you are keeping your money working.

Page 34: Financial institutions have an agenda:

- They want our money.

- They want our money on a regular basis.

- They want to hold onto our money for as long as possible.

- When it comes time to go get our money, they want to pay it back to us as slowly as possible.

Page 35-36: A Cash Flow Insurance policy is contractually guaranteed to grow at four percent interest - that’s 400 to 1,000 percent of what a typical savings account currently provides! Above and beyond that, your non-guaranteed dividends can push up your returns even higher (which is why it is critical to overfund)

Page 37: And even if an insurance company goes out of business and another company doesn’t buy it, every state in the country has guarantees on death benefits and the cash value in policies.

Page 38: Life Insurance policies were once incredibly common. After World War I, there were nearly 120 million life insurance policies in effect in the United States - that’s about one for every US citizen at the time! People had these policies not just for the death benefit, but also for the cash value. They were so common that they even showed up in the movies - in It’s a Wonderful Life, Jimmy Stewart’s character bargains with his adversary using the cash value of his Whole Life insurance policy.

Page 38: For an entrepreneur, a Cash Flow Insurance policy is most effective when used as an opportunity fund or war chest. It provides liquidity when you want it, and when you access the money, you don’t have to write a business plan or go explain the opportunity to a banker. All you have to do is fill out a form, and within forty-eight to seventy-two hours, a check shows up.

Page 39: Once your policy has built enough cash value - usually after one or two years - you can take out a loan against your policy at any time and for any amount up to cash value. Notice that I said “against,” not “form.” When you take out a loan from your Cash Flow Insurance policy, you are not borrowing from your policy, but against it. Therefore, your policy continues to grow as if you hadn’t taken out a loan at all - because you are not actually taking any cash out of the policy. Moreover, you will never have to rush to pay back the loan. In fact, most insurance companies don’t care if you miss a payment, or several payments, or even if you pay them back at all - because if you don’t pay them back, all that happens is the balance is deducted when your death benefit is paid out. Now with that said, I will always encourage you to pay back the loan, allowing that money and more to be used for future loans. Moreover, borrowing against your Cash Flow Insurance will never affect your credit, since there are no such things as late payments. Additionally, if the loan is for your business, in most cases the interest you pay on it is tax deductible.

Finding Money to Fund Your Bank

Page 43-44: Expenses fall into four main categories:

- Destructive expenses, which are vices and weaknesses like drugs and gambling, but also expenses like overdraft fees or any expenses that have a negative effect on your life, that push you toward poverty or debt rather than prosperity.

- Consumptive or lifestyle expenses, such as going on vacation or buying a flat screen TV, are expenses that are fun and build memories, but that don’t build income or assets. They’re expenses that are just for enjoyment. I recommend always using cash for these expenses. It’s important not to cut these expenses out. These expenses are good expenses—as long as they are managed properly.

- Protective expenses, which are used to protect your property and human life value, including your mind- set and happiness. Protective expenses include your liquid savings, which should be enough to cover a minimum of six months’ expenses. These savings won’t be overly productive in terms of earning interest, but they will be there to protect you and prevent you from worrying about money every second. Other protective expenses include life insurance, disability insurance, medical insurance, auto insurance, and emergency preparedness.

- Productive expenses, which are expenses that allow you to expand your cash flow, grow your business, and build assets. These are expenses that lead toward profits and prosperity.

The goal with a Cash Flow Insurance system is to manage these four types of expenses, such that you eliminate your destructive expenses, manage your consumptive and protective expenses, and increase your productive expenses.

Page 45-46: Think of your finances as a three-level pyramid. Level One, the base level, is guarding against uncertainty. This is the area that includes your minimum of six months liquid savings, your life insurance, your estate plan, and your emergency preparedness. Without this foundation, all of your investments are at risk with any financial surprise or issue. Make sure you build level one before moving on to anything else in order to avoid being derailed or risking the loss of everything you have worked so hard for. Make sure that your foundation is secure, and that it can’t be confiscated or lost through some unexpected circumstance or surprise. Level Two, the middle level, is building your Wealth Creation system. If you have funded all of level one, then it’s time to figure out what to do with the rest of your money. Where can you put that money so that it will flow most effectively? What is the best way to preserve money for you? The best way to automatically build wealth is with an infrastructure and system. And finally, Level Three, the top level is advanced investment planning, including discovering your Investor DNA, asset protection, legacy plans, and other growth strategies.

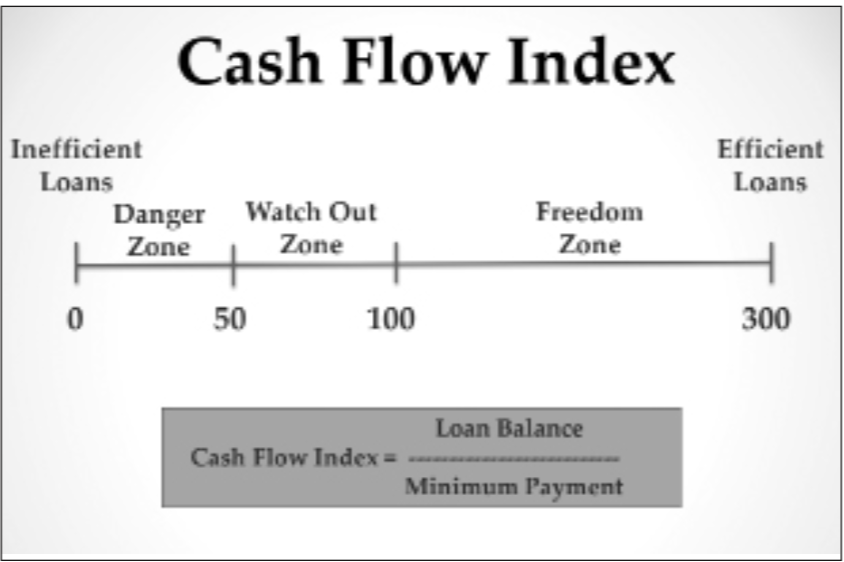

Page 46-47: Part of managing your expenses and stopping leaks is to restructure your loans and manage your cash flow. For this, you can use a tool called the Cash Flow Index, which is a system to help you identify the most efficient way to pay off your loans. You can find your Index by taking the balance of your loan and dividing it by the minimum payment. If your Index is a low number, then it is not an efficient loan; it is a cash hog that requires a high payment relative to the balance. A higher number, on the other hand, indicates a more efficient loan. When you find yourself with extra money that you want to put toward paying off a loan, don’t just pick randomly which loan to put that money toward. Pay the extra money toward a loan with a low Index, an inefficient loan. Paying off a loan with a low Index has the potential to free up much more money, which could mean building savings faster, creating more liquidity, providing more peace of mind, reducing forced payments, and even improving credit scores which could improve interest rates on other loans. Moreover, the money you save monthly by paying off an inefficient, low Index loan can then be used to pay off other loans more quickly! You may even delay paying anything extra to these loans initially. Instead, you can put the money into your Cash Flow Insurance system and then pay the loan off in full when there is enough cash in your plan. This not only saves you money, but also can create more wealth in the future as you build up liquidity, earn interest, and gain the benefits of Cash Flow Insurance.

Page 47-48: When you are restructuring loans, look at refinancing to a lower interest rate or to a longer amortization term, so that the loan will be more cash-flow efficient. If you restructure a fifteen-year mortgage into a thirty-year fixed rate mortgage, you can improve your cash flow, because the payment is lower today and the tax benefits of paying interest for a longer period of time could amount to hundreds of thousands of dollars in tax savings over time. On one hand you are getting tax deductions on interest, and on the other hand you are earning tax preferred inside of a Cash Flow Insurance policy. You can even take the money out against the policy and pay off your home if fifteen years was really your objective.

Page 48: Putting your financial house in order also means creating the proper account structure. Ideally, you want to set up three types of accounts:

- Peace of Mind Account - an account truly dedicated to providing staying power in times of tough cash flow. This account provides risk reduction and creates additional liquidity, enabling you to have money to handle unexpected surprises. It is essential that this account is completely separate from your checking account. The target should be to have a minimum of six months’ worth of savings total.

- Wealth Creation Account - an account focused on growing cash flow and improving the efficiency of your loans. Cash Flow Insurance is the best structure for a Wealth Creation Account and can be deducted directly from your Peace of Mind account. Your Wealth Creation Account can contain at least one month’s worth of living expenses at all times, and is used for productive expenses like continuing education, paying off loans, and funding your Cash Flow Insurance!

- Living Wealthy Account - an account that creates structure around preparing for events like travel and vacations. This is the account that holds the cash for your consumptive expenses. The target should be to start with three percent of your monthly take home pay into this account - money that can then be used for guilt-free spending.

There’s a law in finance called Parkinson’s Law, which states that any time you have an increase in income, if you don’t have a plan for that extra money, it will get eaten up in your living expenses.

Page 49: One final element of putting your financial house in order: understanding your own money personality. There are five main money personality types:

- Saver: A saver is fantastic at building wealth and saving money for the future, but they tend to focus more on worry and live with a scarcity mentality. For a saver, it’s all about what you don’t or can’t do, rather than what you can do. If you are a saver, setting up a Living Wealthy account can help you allocate a portion of your income for guilt-free spending.

- Spender: The spender is the antithesis of the saver. A spender may have five or ten credit cards and ten or twelve other loans. A spender wants to enjoy life at all costs, and has a tendency to overspend on consumptive expenses. Any money that comes in can flow out pretty quickly. If you are a spender, work to set aside at least ten percent of your income into savings. You can still spend and enjoy life, but you will set yourself up for success by taking the first ten to fifteen percent and putting it away, so that Parkinson’s doesn’t end up costing you too much.

- Avoider: An avoider is someone who signs checks and bills without even looking. Avoiders tend not to want to deal with money, ever. It’s a source of frustration, so they just push it off. If you have that tendency, hire a bookkeeper or a coach or a mentor, or find a friend or spouse who can take on that role and hold you accountable.

- Giver: A giver is someone who enjoys helping other people and giving to charitable organizations - but it can be to a fault. Givers often have internal belief systems that make them believe money to be corrupt or evil, or that if they have too much money, other people don’t have enough. A giver’s strength is being generous and giving; their weakness is giving too much and finding themselves in financial trouble. A proper structuring of accounts - including a Charitable Giving account - can help a giver manage their giving.

- Amasser: An amasser is someone who does things in extremes. An amasser loves to make a lot of money and loves to spend a lot of money, loves to save a lot and loves to invest a lot. And if they can’t do all of that every single month, it hurts their confidence. Amassers tend to think about money often. If you are an amasser, organizing your finances and understanding your cash flow can help ease your mind and keep you from being consumed with thinking about money. Create a second scorecard other than money. What makes you feel fulfilled? When do you feel best and what difference would you like to make in the world? By taking action in these areas without only considering how much money it will make, you can be a helpful amasser without having all of your self-confidence in your cash.

You are your greatest asset. Protect yourself and your mindset. Make sure you feel good about your foundation, and then you can be more productive.

Page 52: Cash Flow Insurance is NOT a get-rich-quick scheme. This is about sustainable wealth. Lifelong wealth. Getting rich right. It’s not an investment that is going to double or triple your net worth in a year or two. It’s a system for building LIFELONG wealth, with a rock-solid foundation upon which you can build your overall financial architecture. It provides a safe, steady, and consistent way to grow your wealth, and with that stable financial foundation, you can stretch your wings and swing for the fences in your unique areas of knowledge and interest.

Page 53: Whether you are putting in a hundred dollars a month or ten thousand dollars a month, a system can be designed to work for you. Even if you are living paycheck to paycheck and don’t feel like you have any additional money left over - as long as you have some income, Cash Flow Insurance can still work for you. Even if you have a medical issue that makes you ineligible for life insurance, you can set up a Cash Flow Insurance policy on someone with whom you have an insurable interest or direct relation - a parent, a child, a sibling, a spouse ... or even a business partner! It can help you pay for your kids’ college, pay off loans, or finance your home or car. You can use it as a cash reserve for investing, as seed capital, or as your emergency fund. You can use it for short-term and long-term money management decisions.

Why Whole Life Insurance Beats the Alternatives

Page 55: Most people put their money into a qualified retirement plan such as a 401(k) or an IRA. The problem with these plans is that the accounts are heavily invested in mutual funds. You may think that you have $50,000 in your retirement account, but what you actually have is $50,000 worth of shares in the mutual fund. If the market goes down, those shares could drop in value and all of a sudden your

money is halved - which is what happened to many people in the 2008 financial crisis. Money kept in a Cash Flow Insurance policy, meanwhile, is hardly affected by the stock market.

Page 56: By the late 1970s, companies began to switch over to 401(k) plans, which enabled companies to set aside money into the 401(k) as part of the employee’s paycheck. Then, the stock market returns would fund the employee’s retirement, instead of the company having to do it. This worked well, as long as the stock market was also doing well—as it was from 1982 through 2000. But from January 14th, 2000 (the day the stock market reached its highest point in 2000) to January 14, 2015, the stock market was up 8.4%, adjusting for inflation—or just 0.54% per year. That return is not enough to fund a retirement! And so, like the pension, the 401(k) is reaching the end of its days.

There is only one method of saving money that has survived for over a hundred years, that lasted through the Great Depression and through the 2008 recession, and that is still going strong today: Whole Life insurance.

Page 57: Mutual life insurance companies, on the other hand, do not trade on the stock market. You can’t buy them in your 401(k) because they have no shares. They’re similar to credit unions, except the policyholder is an owner in the insurance company.

Page 61: Of all of the term policies purchased—of all of these bets made—only 1.11% end with a payout to the policyholder. In other words, the insurance company “wins” the bet ninety-eight plus percent of the time.

Page 65: Unlike term life insurance, where your premium money is gone forever, the premium money you are putting into a permanent life insurance policy is still yours to use while you are alive, and it will 100% certainly be returned to your beneficiaries after you die. No lost money here!

Page 69: Whole life provides more certainty than any other life insurance contract. It is not affected by market fluctuations, the cost of insurance will never increase, and insurers can’t take back dividends, or ask for higher premiums, or take away the death benefit. Even if you miss a payment, the guarantees are not negated. The premium is just taken out of the cash value, and the death benefit remains guaranteed—another reason it is critical to fund the policy properly, as it will give you more flexibility earlier.

Setting Up Your Family Bank and Cash Flow Insurance the Right Way

Page 72: The Rockefellers designed trusts to protect the family wealth. But a trust is a trust because you’re giving up legal ownership of assets and entrusting them to someone else. Is it still possible, then, to maintain some control over the family wealth and make sure it is preserved? Yes, and for my trust, the answer is to look at the trust like a corporation, complete with a CEO and a board of trustees. A CEO typically has three key responsibilities: to establish the company vision, to establish the company culture and to look after the shareholders’ financial interests. And that’s exactly what I do for my family trust. I've established the vision by thoroughly writing it down in my Statement of Purpose. I've established the culture by setting an example for my kids, and one day their kids. And I’m the one adding money to the trust and guiding it for the benefit of my heirs. My trust also states that during my lifetime, I have the power to overrule any withdrawal from the trust. So while the trustees have the legal right to distribute assets from the trust at any time, they can’t do it without my approval.

Page 73: Clearly, selecting the people who will protect your family wealth after you’re gone is not a matter to be taken lightly. You must think about those that best understand your financial philosophy, who will respect your wishes and who will best represent the choices you’d make if you were still around to make them. My advice is to start with people who share your values and can teach those values to the next generation. Another way to think about it is if you were to start a company today, who would you partner with or put on the board of directors?

Page 75: So by creating a carefully-chosen board of trustees and appointing a trust protector, all of whom know me and my financial philosophy extremely well, I can feel confident that my family trust will be managed responsibly even after I’m gone.

Insurance is a tool, not an investment.

Page 79: The first step when setting up a Cash Flow Insurance account is to pick a company with which to purchase your policy. Here are some factors to look at:

- Ratings - don’t go for any company with less than an A rating across the board - with Moody’s, A. M. Best, Standard & Poor’s, etc. Choose a top ten to fifteen mutual insurance company.

- How old the company is - we would only recommend companies that have been around at least a hundred years.

- Make sure they pay dividends, and that they have a solid history of always paying dividends, including through the World Wars, the Great Depression, and the 2008 financial crisis.

- Check their current interest rates on the loan provisions and make sure there is a fixed option; you don’t want a variable interest rate.

- Make sure there are no unreasonable charges for withdrawal or fees for borrowing money.• Make sure their term insurance rates are competitive and convertible to their Whole Life policy.

- Make sure they have a good Whole Life product or portfolio.

- Go for companies that have high early cash value.

There are about a dozen or so mutual life insurance companies that fulfill all these requirements.

There is a maximum amount of insurance that a company will issue on your life. Find out what that number is. That is the amount I recommend you acquire. When you own the maximum amount of life insurance, you will know—not just hope, but know - that if something happens to you, you cannot possibly do any better for your family.

Page 82: Protection leads to production, not just in terms of earning money, but in terms of the quality of your life. That peace of mind will translate into your life - into clarity, joy, and the mental space and creativity that allows you to create and produce more. This higher production and quality of life that awaits you will more than pay for the increased coverage.

If you cannot get a policy on yourself, you can still open a Cash Flow Insurance policy by taking out life insurance on your spouse, child, parent or business partner.

Page 86: When you overfund a Whole Life insurance policy, it can actually lower the commissions to agents by up to fifty to seventy percent on every dollar. Why? Because those overfunding dollars are going straight to the cash value rather than toward the base premium (with the right companies). So in order to make larger commissions, agents will sell you a policy that is not cash rich in the first two or three years.

Page 87: This overfunding is done through something called paid-up additions. Paid-up additions are extra money/overfunding that you are putting into your policy beyond what the policy would require. It’s a way of supercharging the cash value of your policy. This not only increases your cash value more quickly, but also grows your death benefit. You can also set up your policy so that at least fifty percent of the money you put into it in the first year shows up in cash value.

Page 88: If you put too much money into your policy, it becomes what is called a modified endowment contract (MEC). Basically, that means you are funding the policy at a level where you pass the corridor of cash value to death benefit and the government treats it more like an annuity than an insurance contract. This is easily avoided with simple calculations and communication.

Overall, the best method is to put as much into your policy as your cash flow will allow. Building to 15% of your income is ideal, but what is most important is just getting started.

Page 89: Paying off or restructuring inefficient loans is a great way to free up cash flow to put into a Cash Flow Insurance policy. People often think that what matters the most is paying off loans as quickly as possible. Financial gurus like Suze Orman are always saying to shorten your mortgage and other loans. However, if you shorten your mortgage or loans, it forces you into higher payments, which can provide more risk and increase your debt-to-income, lowering your cash flow and ability to borrow.

Page 90: If you refinance your fifteen-year mortgage into a thirty-year mortgage, you can take the payment that would normally go toward a fifteen-year mortgage and put it into your Cash Flow Insurance policy. You’ll find that in about fifteen years, you’ll have enough cash value to pay off the remainder of your mortgage. Then you can pay the rest of the mortgage payment you would have made back into your policy, and end up with more money than either someone who had a fifteen-year mortgage or someone who had a thirty-year mortgage but didn’t take

advantage of the cost difference—all with the possibility to be more tax efficient.

Costs and Benefits: What’s In It for You?

Page 94: Moreover, if you take a loan against your policy, that loan won’t be taxable either. This isn’t a deferral, where you are going to have to pay it next year instead of this year. It’s permanent. You can set your payback schedule on the loan. You can make the choices, and charge yourself - or anyone else you loan money to - whatever you want. A loan taken out against your policy is one of the most private loans you can ever make.

Page 95: A bullet fund is money you have set aside that you can pull from when you want to seize an amazing opportunity at a moment’s notice. A war chest is money that can be used for any unexpected surprise that money can help you solve - whether it’s a lawsuit, a cash flow crunch, or the need to pay off something with a high interest rate. Having your wealth growing inside a Whole Life insurance policy allows you to seize opportunities as they arise.

Page 96: We can all agree that saving money is great. What most people don’t realize is how much saving on taxes and loan payments can truly impact their lives.

Page 97: Do you know how much money you would have to invest to find $15,000 a year in cash flow? If your investment earned five percent, you’d have to invest 300,000 dollars. But you can get that same return just by optimizing your cash flow.

Using Cash Flow Insurance and some basic tax strategy, you can decrease your tax burden by 10%—meaning 10% of the 40% average,so 4% total. So you are now paying a total of 36% on taxes. Using the cash flow index to identify inefficient loans - and working to pay off those loans - can reduce those expenses by half. But to be conservative, we’ll say that you have reduced your loan payments from 35% to 20%.

Page 101: So what is the solution to keeping more money in your pocket? It is to reduce those eroding factors. Let us say right off the bat that the factors we want to focus on reducing are taxes and loans, NOT lifestyle! I want you to be able to keep your lifestyle, if not increase it. Chasing a higher rate of return is not the answer. The answer is to focus on leverage, efficiency, utilization of your money, and decreasing eroding factors.

Page 103: The list of benefits Cash Flow Insurance provides goes on and on. You have cash, you can access it completely, you can earn interest instead of paying interest, you can save on term insurance costs, you can save on taxes, you can take cash out in a tax-favored way, your money can be protected from lawsuits and bankruptcy, and your guaranteed returns on the policy are at higher rates than what you see in almost any other savings vehicle. Most importantly, Cash Flow Insurance creates a solid base level which can always keep you safe.

The cash value of a Whole Life insurance policy is both accessible and guaranteed. You know for certain, year by year, every year, how much money will be there. That advantage of knowing versus hoping can be leveraged in all areas of your life, especially as you make short- and long-term finance decisions.

Turning the Death Benefit Into a Living Benefit

Page 107: There’s an old axiom that nobody ever gets wealthy off of life insurance while they’re alive. That may be true for a typical life insurance policy, but this is a little different thanks to a major asset in your Cash Flow Insurance policy: the permanent death benefit.

Page 109: If you have a death benefit, you don’t have to worry about continuing your pension after you die. Your spouse and your heirs will be provided for—and the money will be income-tax free. This strategy of taking the maximum pension and using the death benefit to replace it is called pension maximization.

Page 111: If you have a highly appreciated asset—such as real estate or your business - you may want to sell it to support your later years of life. There are plenty of strategies for deferring the capital gains tax you would have to pay; but what if I told you there are completely permanent tax strategies for avoiding those taxes? You can do this by using what’s called a charitable remainder trust. If you sold a $1,000,000 building, you would have to pay anywhere from $200,000 to $300,000 in tax, leaving you with $700,000 from the sale. If you use a charitable trust, you can donate that building to the charity of your choice—a university, a church, a cause, or some 501(c)3. When you donate, a portion of the value of the donated asset is tax deductible. Of course, the design of a charitable trust is that when you die it goes to the charity and it disinherits your family. However, you can you set up a charitable trust so that you are the first beneficiary, and the charity the second beneficiary. That means that all you have to do is leave at least 10% to the charity when you die - which, in my opinion, is much better than giving 40% to the government! That’s where the Rockefeller Method comes in: you can use your life insurance that the Cash Flow Insurance system provided to replenish the gift back to the trust in a tax-free fashion. Now, your family has a bank inside of the trust to borrow from and replenish, and when they get their own life insurance, they can continue to replenish the trust down through the generations.

Generational wealth will typically last about two generations before the money is all spent. This is a way to ensure that your wealth continues beyond that. The death benefit can replenish the trust when one generation utilizes the money, and even in the case of market changes or mistakes, the death benefit becomes a contingency plan for replenishing the trust. Moreover, this allows you not only to pass down generational wealth, but also to create a value system for your kids, your grand kids, and your great-grand kids, so that they know your name, your values, and what you stood for. You can change the destiny of your family by utilizing these policies properly, all while living your life to the fullest in your later years.

Page 113: Cash Flow Insurance is a way to leave a financial legacy, to empower your children and share more of your human life value with them, and to help ensure that the wealth you leave them is a blessing—not a curse. We learn the most being the teacher.

Buying Your New Worth Instead of Building It

Page 118: How much money would you have to put away if you wanted to have a five million dollar nest egg? How many market swings would you have to survive, and how much would you have to risk? How many fees would you have to pay? And how much time, effort, stress and worry would you have to endure to make it all happen? That’s why, instead of trying to build net worth, buy it. If you buy a Whole Life insurance policy with a guaranteed five million dollar death benefit, you have instantly added five million to your estate.

But there is one thing that is certain and predictable: death. By purchasing a death benefit through Whole Life insurance, you have a future sum of money that is contractually guaranteed from day one.

Page 120: Buying your net worth also has another major advantage over building your net worth: you can do it right now. Building your net worth takes time. But if you are older, and you don’t have as much time, you can buy your net worth instead. You can secure a 100% income-tax free asset that can be passed on to the next generation, and that you can utilize in order to live fully and access your net worth in your later years, Rockefeller style.

Getting a House or a Car with Your Bank

Page 123: Financial gurus will tell you that you should always pay cash when making big purchases like a house or a car. They tell you never to finance if you can help it in order to avoid unnecessary interest payments. In some cases, they are right. But if you use Cash Flow Insurance, I have a surprising fact for you: financing big purchases can actually make you rich. The fact is, while financing costs you in interest payments, paying in full with cash costs you in opportunity - this is called “Opportunity Cost.” Simply put, opportunity cost is what you miss out on when you choose one option over another. In other words, every decision you make in life includes an opportunity cost - the option you did not take. And it can cost you thousands of dollars each year if you don’t understand or acknowledge it.

Page 126: Because you are borrowing against your policy and not from it, the actual cash in your policy remains untouched. No money is removed from your account. Therefore, the money in your account can continue to compound and grow, completely uninterrupted. Then, when you've paid the loan back in five or ten or however many years - as discussed—you are paying back into a cash value that is exponentially higher than when you took out the loan.

Page 126: Let’s compare three different ways to buy a car, and see what happens over a twenty-year span if you buy a new car every five years:

- Buying a car with credit

- Buying a car with cash

- Buying a car by borrowing against your Cash Flow Insurance policy

To make the comparison easy, let’s say in all three of these cases, you are starting with zero dollars to put toward this purchase.

Scenario 1: Buying a car with credit is the most common purchasing strategy. Credit means borrowing someone else’s money in order to get the car you want immediately. Then, you pay off that loan—in this case, let’s say you pay off the loan over the next five years. When buying with credit, the opportunity cost is the interest you pay on the loan. After five years, you've paid off the loan, and it’s time to buy a new car. However, when you factor in a 2.5% rate of inflation over those five years, you’ll have to borrow a little more in order to buy the same quality car. This will repeat every five years over the twenty-year span.

Scenario 2: If you wanted to buy a car with cash, the first thing you’d have to do would be save up for it. In this scenario, starting at zero, there would be no way for you to buy a car with cash today. In order to buy a $25,000 car within five years, you would need to save $413 a month. However, once that 2.5% inflation rate is calculated, in five years that $25,000 car will cost $28,285. So in order to buy that car in five years, you either need to increase your savings to $468 a month, or have your savings earn 2.5%. When buying with cash, you face two opportunity costs. During the five years of saving, your opportunity cost is not having a car. Then, once you buy the car and your cash reserve goes back down to zero, your opportunity cost is not being able to use that money on other things—including emergencies—as well as not being able to earn any interest on that money.

Buying with credit and buying with cash have the same ultimate result: at the end of each five-year period, you end up with a car you own outright, and zero dollars in cash remaining. The difference is just that with credit, you get your car immediately, and with cash you have to wait. But financially speaking, it doesn’t make much of a difference which method you use, cash or credit.

Page 128: Now, what this doesn’t yet take into account is any interest earned on the saved cash. Let’s say that you are saving the exact same amount of cash each month that you would be paying back, with interest, on a loan. Then, let’s say you’re putting that saved money into a traditional savings account or CD, which these days has about a 1% interest rate. Even with this small interest rate, you would have more at the end of every five-year period than the cost of the car. And at the end of the twenty-year span, you’d have accumulated an extra $11,938 - much better than using credit and ending up at zero! The downside, of course, is that you still can’t get your car right away at the beginning—you still need that initial five years to save up. However, if you are able to take that five years, you are actually much better off buying with cash than with credit.

Page 128: Thankfully, there is a third option that gives you the best of both worlds: using your Cash Flow Insurance and taking out a policy loan against your cash balance. If you are starting from zero, you will still need that initial five-year period to save up. However, when you take out that loan against your policy, you leave your money in your account to continue compounding, uninterrupted. So, when you pay back your loan, you are back to your full account balance - plus all the compounding interest you have earned during those five years! Instead of ending up after twenty years with $11,938 more than when you started, you’ll end up with over $20,000 more—77% better off than you were paying cash.

Page 128: As if that wasn’t great enough, there’s also the fact that you are not paying interest solely to a financial institution. Imagine if you took a five-year, $20,000 loan out from a bank at 7% interest. Your monthly payment on that loan would be $396.02, and at the end of the five years, you would have paid $3,761.44 in interest alone. Why not pay that spread back to yourself, rather than all to a bank? This strategy can be used in all your large purchases, not just on

cars. You can even use it to buy your dream house!

Borrowing money from banks, credit card companies, or other lenders is in fact one of the most damaging things you can do to your wealth. It puts you in a hole that can be almost impossible to dig your way out of.

Your Bank ... Your Legacy ...Your Financial Future ... Why Wait?

Page 132: Our philosophy is not about saving or sacrificing, delaying or deferring. It is about building a lasting legacy. It’s about being your own bank, so that you are able to take advantage of opportunity, rather than being taken advantage of. It’s about rigging the game in your favor. It’s about freeing up cash flow without infringing upon your lifestyle. It’s about being able to plan and work toward your future vision while still living fully and enjoying today, because YOU are the one in control.

Another critical aspect of the Rockefeller Method is passing on more than just money from generation to generation. It’s about passing on values, philosophies, contribution, and opportunity, to name a few. The Rockefellers treat their legacy like a business. This is done through the proper set-up and execution of an estate plan, and, more importantly, your board and Statement of Purpose.

Page 133: A method is to write down a Financial Premise, a Financial Vision, a Financial Purpose and a Financial Strategy for each area of life where I have wisdom to share.

Page 137: THE FINANCIAL TO-DO LIST

- Get crystal clear on your financial status. NOW! And always!

- Get your kids set up and learn how to use savings plans NOW!!!

- Hire an accountant and create a cash flow plan and a savings plan.

- Put together a complete financial strategy and comprehensive financial blueprint (start with a Wealth Factory Financial Health Assessment).

- Save a minimum of 18% of every check from now on.

- Set up a Wealth Capture Account that you use to separate your spending money from your investing money.

- DON’T LOSE MONEY

Start Your Statement of Purpose Now

We all pick up bits of wisdom and insight over the years. It’s not necessary to wait until you form your family trust to begin writing them down. You can start your Statement of Purpose now and write down your thoughts as they come to you. It doesn’t have to be perfect. If your descendants expect perfection from you, they expect too much (you can even state that in your Statement of Purpose). But it is very valuable to pass along information to the next generation so that, just like with money, they’re not starting life at zero.

Page 142: We don’t know what the future will bring. Take advantage of your good health and your family’s good health. Take advantage of the favorable laws. Start living your life more fully now, knowing that your future is secure. Find financial freedom by being your own bank, setting up your family for generations to come, and taking step one by setting up your trust and Cash Flow Insurance today!